Exactly How To Identify An Effective Insurance Policy Agent: Crucial Elements To Evaluate

Author-Abrams Stage

To detect a good insurance policy agent, focus on their ability to articulate complicated insurance coverage terms in such a way that makes sense to you. A top-notch representative will certainly listen diligently to your demands and provide customized options with precision. Yet do not stop there, understanding the industry details and remaining abreast of adjustments are equally important. And let's not forget the power of client reviews; they often disclose a lot regarding a representative's performance history. So, what are the indications that really make an insurance policy agent stand apart from the rest?

Interaction Abilities

When looking for an excellent insurance policy agent, among the essential top qualities to seek is strong communication skills. It's critical that your agent can clearly explain complex insurance terms and plans in a manner that you can comprehend. A good agent should actively listen to your worries and questions, and have the ability to give you with concise and exact details.

Reliable interaction also involves being receptive to your requirements. why not check here will keep you notified about any type of updates or modifications to your plan, promptly return your telephone calls or e-mails, and be offered to deal with any kind of issues that may occur.

They must be able to adapt their interaction style to suit your preferences, whether you favor phone calls, emails, or in-person conferences.

Clear and open communication builds trust in between you and your insurance policy agent, making certain that you feel great in the insurance coverage and suggestions they offer. When reviewing potential representatives, pay attention to how well they communicate with you, as this can make a considerable difference in your general experience.

Sector Expertise

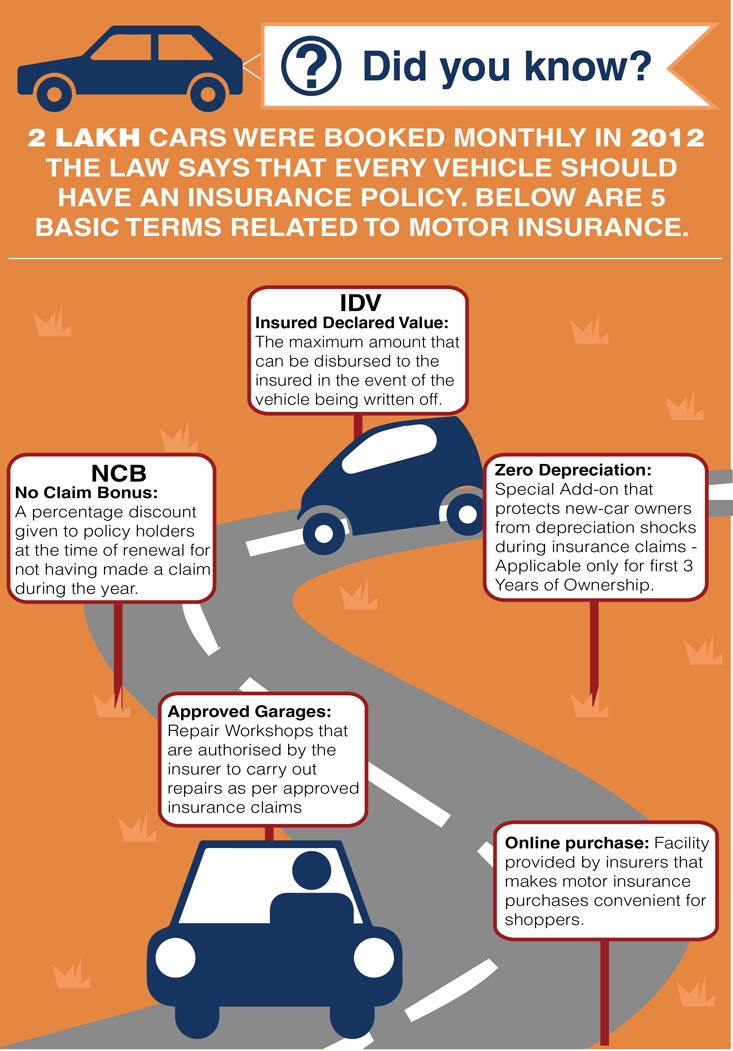

Having a solid understanding of sector knowledge is extremely important when picking an insurance coverage agent. When trying to find a good insurance agent, it's important that they have actually a deep understanding of the insurance sector, including various types of policies, insurance coverage alternatives, and the latest regulations. A representative who's skilled in the sector will certainly have the ability to offer you with exact details, guide you with the complexities of insurance policy, and aid you make notified choices about your protection needs.

An educated agent will certainly additionally have the ability to evaluate your certain situation and advise one of the most ideal policies customized to your specific needs. They must be able to describe the terms and conditions of different policies in a clear and understandable fashion, making certain that you're totally knowledgeable about what you're acquiring.

In addition, a representative with solid sector expertise will certainly remain upgraded on any modifications or brand-new developments in the insurance policy sector, making sure that you get the most current and relevant suggestions. When choosing an insurance representative, focus on industry expertise to ensure you obtain superior solution and advice.

Client Reviews

Comprehending the value of industry understanding when selecting an insurance policy representative, it's likewise a good idea to take into consideration the experiences of past clients with customer reviews. Client assesses offer valuable understandings right into a representative's reliability, interaction abilities, and general consumer complete satisfaction. By reviewing find out this here from individuals who've worked with the representative, you can assess their professionalism and reliability and performance in dealing with insurance policy issues.

When assessing customer reviews, pay attention to reoccuring themes or patterns. Seek remarks about timely actions, personalized interest, and successful insurance claim resolutions. Favorable evaluations highlighting these elements can indicate a trustworthy and competent insurance policy representative that focuses on customer needs.

On the other hand, adverse testimonials mentioning concerns like lack of openness, delayed responses, or trouble within the agent might act as indication. These testimonials could signify possible challenges you may come across when managing the representative.

Conclusion

Finally, when looking for a good insurance representative, focus on their interaction abilities, sector understanding, and customer evaluations. A great agent will be able to discuss insurance policy terms plainly, stay up-to-date on industry adjustments, and have favorable comments from previous customers. By taking into consideration these factors, you can ensure you are working with a dependable and efficient insurance agent for your demands.